How to Compare Medicare Advantage Plans

TABLE OF CONTENTS

I. Getting Help

Medicare consists of three parts:

- Medicare Part A, which covers hospital and facility costs, including shared hospital rooms, meals, nursing care, hospice, home health care, and skilled nursing facilities

- Medicare Part B, which covers healthcare that happens outside a hospital, including doctor visits, outpatient procedures, some preventive care, like flu shots

- Medicare Part D, which is a prescription drug plan. Although these plans are sold separately by private health insurance companies, Medicare users must have a prescription drug plan.

Medicare Advantage, which is also known as Part C, is a related program through which customers can buy health insurance “bundles” containing Part A, Part B, and usually Part D, from private insurance companies. This option gives customers more flexibility than Original Medicare, which means there are a number of factors to consider when selecting a plan.

II. Original Medicare vs. Medicare Advantage

If you’re still uncertain about whether you should enroll in Original Medicare or Medicare Advantage, here is a breakdown outlining their key similarities and differences:

| ORIGINAL MEDICARE | MEDICARE ADVANTAGE | |

| SIMILARITIES | ||

|

||

|

||

| DIFFERENCES | ||

| Offered By |

|

|

| Out-of-Pocket Costs |

|

|

| Coinsurance vs. Copayments |

|

|

| Coverage |

|

|

| Network |

|

|

| Travel |

|

|

| Supplemental Insurance/Medigap Availability |

|

|

It is important to consider all of these factors when choosing between Original Medicare and Medicare Advantage. For example, if you are someone who frequently travels abroad or needs hearing or vision care, Medicare Advantage might the better choice for you. However, if you need Medigap assistance, or have doctors who are not part of your Medicare Advantage plan network, you should enroll through Original Medicare.

III. Enrollment

Regardless of whether you pick Original Medicare or Medicare Advantage, returning customers have the ability to switch plans during designated annual enrollment periods:

- October 15-December 7: Open enrollment for Medicare Advantage and Medicare prescription drug coverage

- January 1-March 31: Open enrollment for Medicare Advantage and Original Medicare

- April 1-June 30: Enrollment for individuals who have Medicare Part A coverage and enrolled in Medicare Part B during the general enrollment period.

Customers who are enrolling in Original Medicare or Medicare Advantage for the first time also have a set time frame to apply:

- Individuals turning 65: The three months prior to turning 65, the month you turn 65, and the three months after you turn 65.

- Individuals under 65 with a disability: The three months before your 25th month of getting Social Security or RRB disability benefits, the 25th month of getting disability benefits, and the three months after your 25th month of getting disability benefits.

Individuals who fail to sign up for Medicare benefits during these time frames may face penalties, with the exception of people who are actively employed and receiving health insurance from their employer. If you are approaching age 65 and are still working, consult with your employer to find out if your coverage will continue, or if you will need to switch to a Medicare plan. You will also be able to join Original Medicare or Medicare Advantage during a special enrollment period if your employment situation changes.

IV. Comparing Medicare Advantage Plans

When it’s actually time to select a Medicare Advantage plan, you can compare plans using Medicare.gov’s Plan Finder tool.

Because Medicare Advantage plans are offered by private health insurance companies, the plans that are available to you will depend on your location, and which health insurance companies operate there.

More detailed instructions on navigating the Plan Finder tool are below, but first, here are some things to consider when comparing plans:

| Healthcare needs | What are your specific healthcare needs? How is your overall physical and mental health? Do you need a plan that covers certain specialists, procedures, or drugs? Consult with your primary physician and any other doctors you regularly visit to get an accurate assessment of your health and healthcare needs, so you know exactly what kind of coverage you need. |

| Costs | What is your budget? What is the cost of the monthly premium versus the deductible versus the out-of-pocket costs for care and prescription drugs? Estimate as best you can what your healthcare costs for the year will be, and calculate them against those three factors to figure out what plan will give you the best care for an affordable price. |

| Benefits | What does the plan actually provide? All Medicare Advantage plans provide basic coverage for hospitals, hospice, skilled nursing facilities, doctor’s visits, outpatient treatment, and some preventative care, with the ability to add coverage for things like vision, dental, and hearing. Make sure the plan you are selecting offers all the critical benefits you need. |

| Plan Types | When comparing Medicare Advantage plans, you may see up to four different types of plans:

It’s important to understand the differences between each plan type before selecting one, as this can affect the type of coverage you receive, the doctors you can see, and your overall costs. |

| Network | Does your doctor or the facility where you regularly receive treatment accept this Medicare Advantage plan? Because Medicare Advantage plans only cover in-network care, you will want to be sure to pick a plan that includes your doctor in their network. Otherwise you will pay higher out-of-pocket costs, or be forced to find a new doctor who accepts your insurance. |

| Rating | How do users rate this plan? Plans are rated on a scale of one to five stars based on the quality of their health and drug plans. The more stars a plan has, the higher the quality it is.. |

V. Using Medicare.gov’s Plan Finder Tool

You can use the Medicare website to compare and shop for Medicare Advantage plans.

Step 1: Go to https://www.medicare.gov/plan-compare/#/?lang=en

You can create an account with your Medicare Number, last name, email address (if you have one), date of birth, zip code or city, and the date your Medicare Part A coverage started or will start. If you already have an account, you can log in, or you can browse plans without logging in or creating an account.

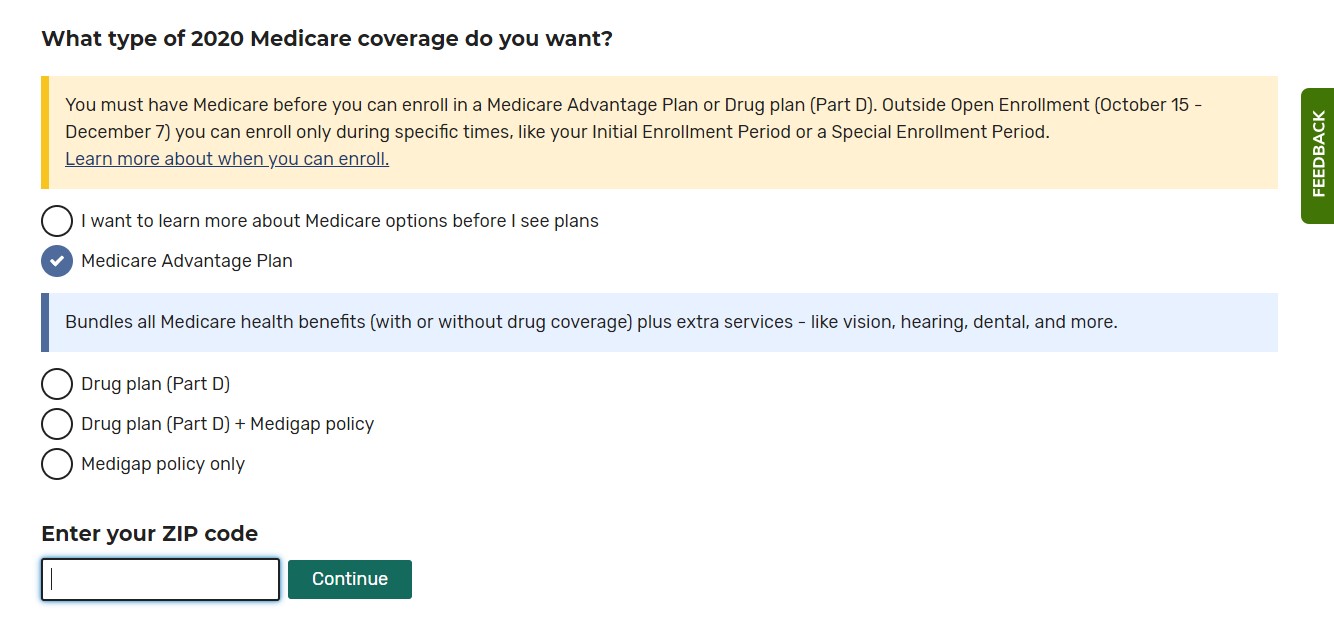

Step 2: Answer a few quick questions

On the next page, you will answer a few basic questions about what you are looking for on the website. Follow the prompts to answer the questions to tailor your search results to your needs.

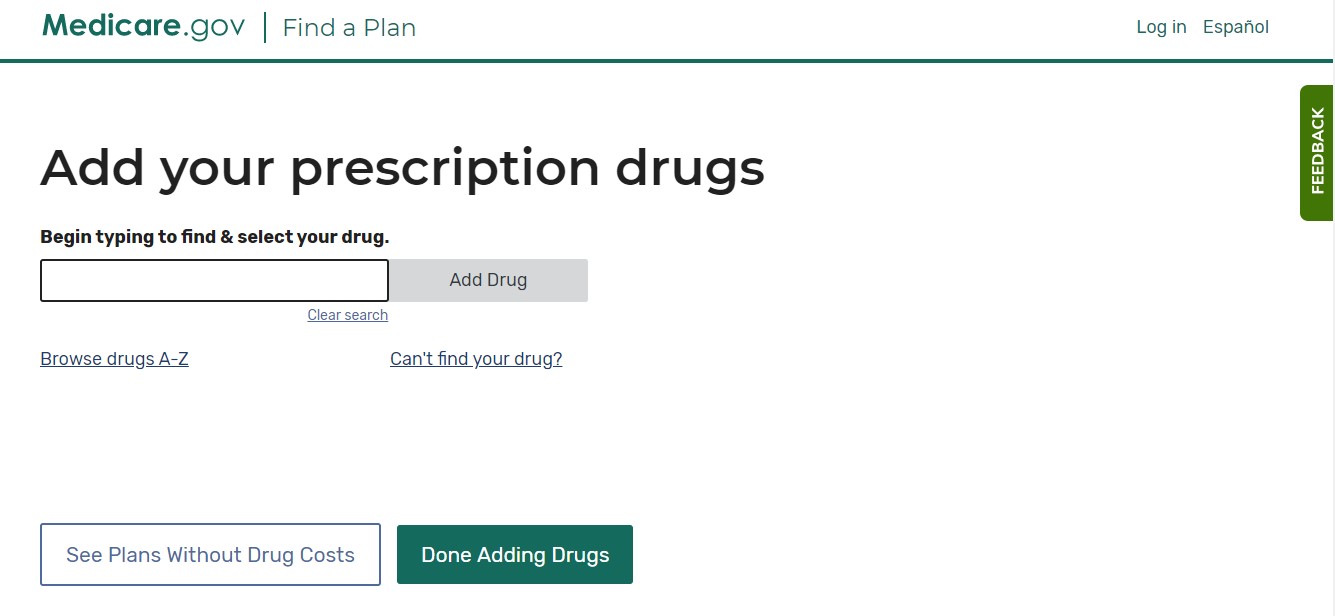

Step 3: Set search preferences

Next you will answer brief questions about prescription drugs, including if you want to see prescription drug costs for the plans you are comparing. If you select “yes” for this question, you will then be prompted to enter information about all prescription drugs you take, as well as the pharmacy(ies) where you fill your prescriptions.

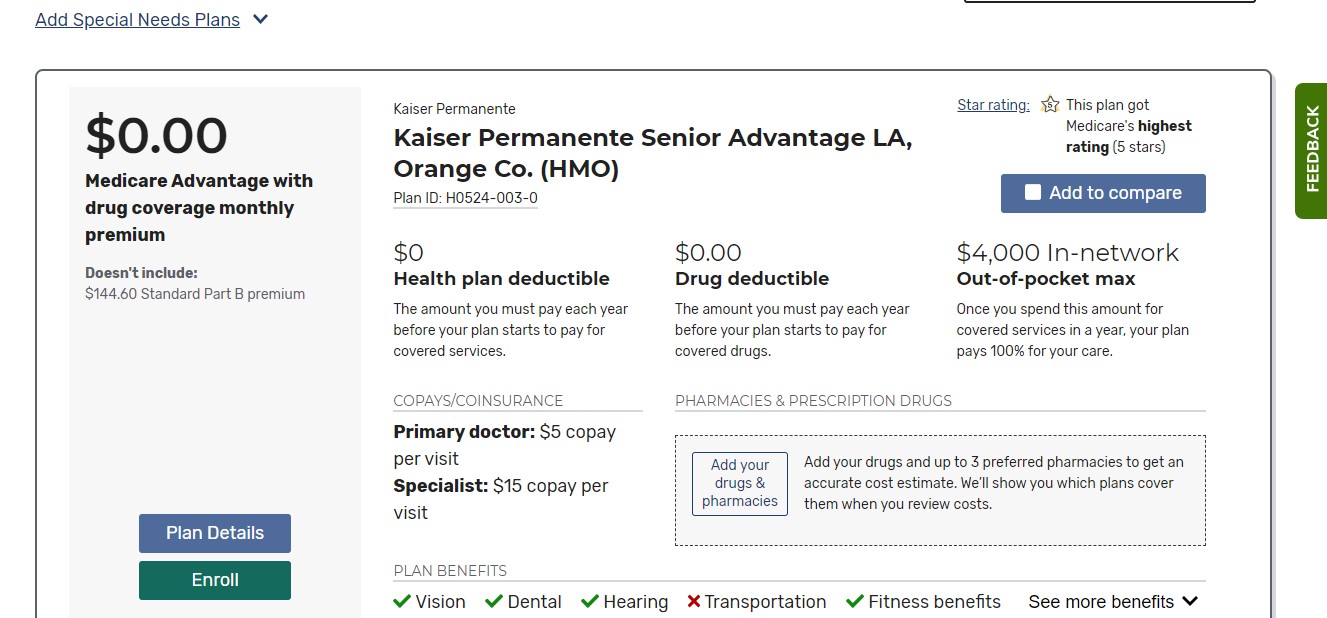

Step 4: See available plans

Once you input the necessary information, the Plan Finder will do a search of all available plans in your area. This page will show a snapshot of the available plans, including premium cost, deductibles, copays, plan benefits, and drug plans, if you chose to see that information.

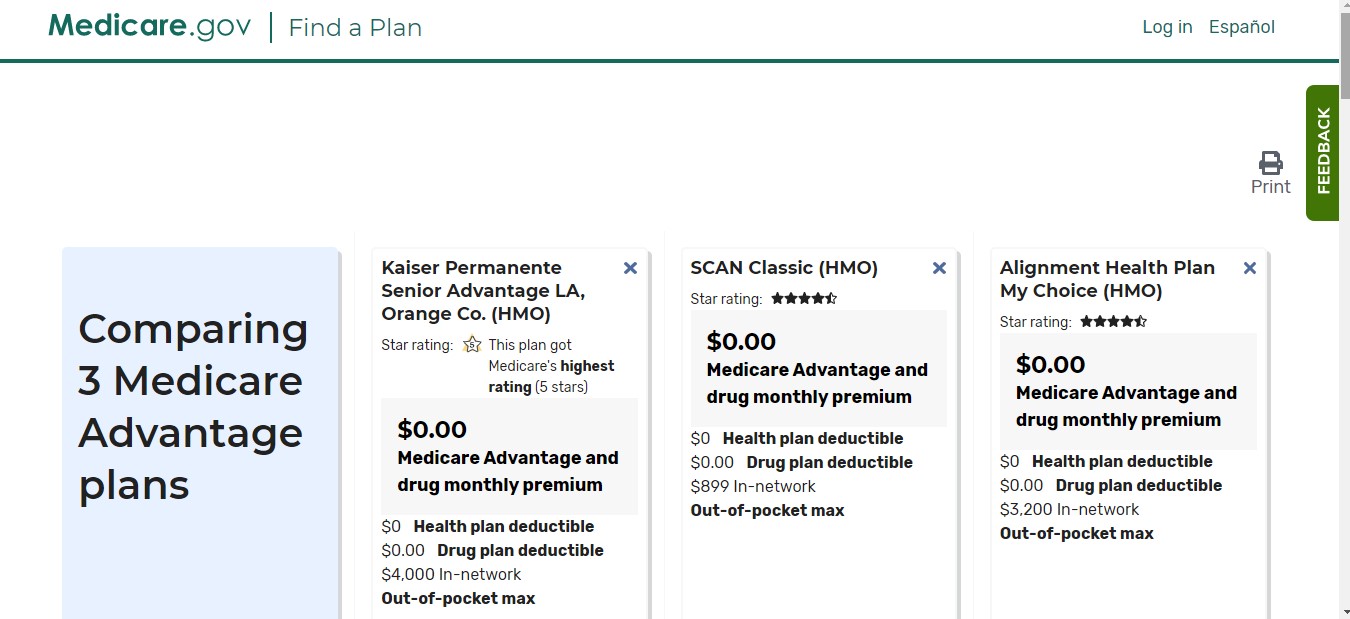

To see more in-depth information, click on the “Plan Details” button. You can also do a side-by-side comparison of up to three plans by clicking on the checkbox in the “Add to Compare” button. You can do as many three-plan comparison configurations as you wish. You can also filter plans for certain coverage options, star ratings, and insurance carriers to narrow your search.

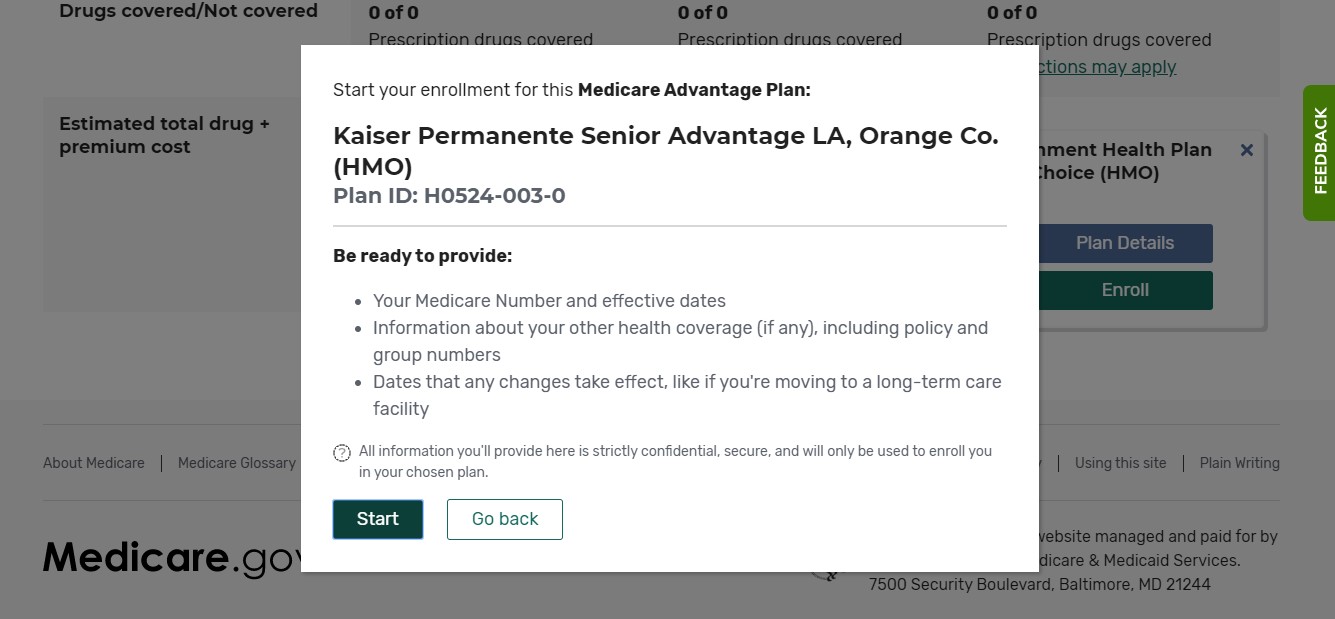

Step 5: Enroll!

If you decide on a plan, you can start the enrollment process right now, provided it is an initial enrollment period, open enrollment period, or you meet the criteria for a special enrollment period.